See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Famous Buffett Quote The prices of the metals didn’t change much this week. We thought we would take this opportunity to quote Warren Buffet. A comment he made at Harvard in 1998 earned him the scorn of the gold community. “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.” We don’t care much for his conclusion either: no need to own gold, nothing to see here about our failing monetary system, move along folks. However, he does have a point. When the government expelled gold from the monetary system, it took away gold’s utility. Gold does not pay interest today. That’s why most people want nothing to do with it. And it’s also why the gold community is so focused on the price of the metal. Other than protect you from the End Of The World As We Know It, gold is a chip for betting in the speculation casinos. Without interest, it cannot circulate as money. Interest is the flow regulator valve. Zero interest means 100% hoarding and 0% circulation. The concept of utility comes from being able to use something.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price, silver ratio, Warren Buffett

This could be interesting, too:

Vibhu Vikramaditya writes Navigating the Slippery Slope: How Hoover’s Interventions Paved the Way for the Great Depression

Ryan McMaken writes Frédéric Bastiat Was a Radical Opponent of War and Militarism

Douglas French writes Millennials: In Costco We Trust

Joseph T. Salerno writes What Fed “Independence” Really Means

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

The Famous Buffett QuoteThe prices of the metals didn’t change much this week. We thought we would take this opportunity to quote Warren Buffet. A comment he made at Harvard in 1998 earned him the scorn of the gold community.

We don’t care much for his conclusion either: no need to own gold, nothing to see here about our failing monetary system, move along folks. However, he does have a point. When the government expelled gold from the monetary system, it took away gold’s utility. Gold does not pay interest today. That’s why most people want nothing to do with it. And it’s also why the gold community is so focused on the price of the metal. Other than protect you from the End Of The World As We Know It, gold is a chip for betting in the speculation casinos. Without interest, it cannot circulate as money. Interest is the flow regulator valve. Zero interest means 100% hoarding and 0% circulation. The concept of utility comes from being able to use something. Money is used for investing and spending—precisely what the government has suppressed since 1933. So what’s left? Price action. |

Warren Buffett no doubt is a good investor; but he is also one of the biggest beneficiaries of the vast monetary inflation since the 1970s, a wind that has been at his back ever since. He also doesn’t seem to understand gold. We don’t say this lightly – his comments on the metal really do sound uninformed most of the time; regardless of the fact that the point Keith discusses below may have some merit in a specific context . |

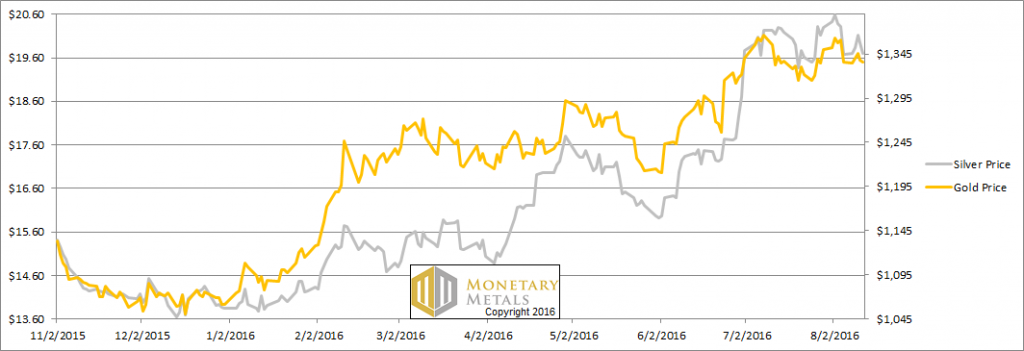

Fundamental DevelopmentsRead on for the only the only true picture of the supply and demand fundamentals that ultimately drive the price action. But first, here’s the graph of the metals’ prices. |

|

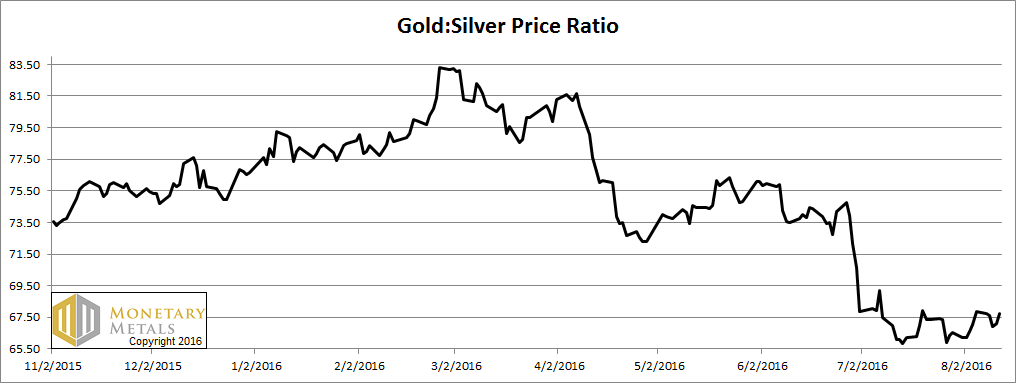

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. |

|

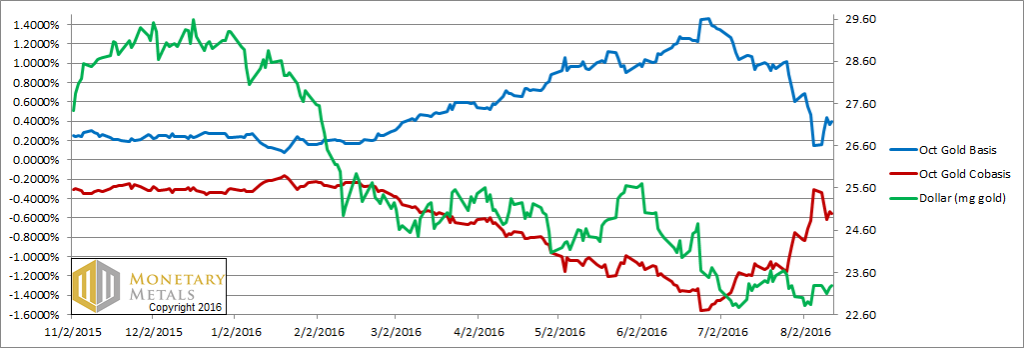

Gold basis and co-basis and the dollar priceHere is the gold graph. The basis (i.e. abundance) increased a bit this week. However, our calculated fundamental price rose a few bucks. |

|

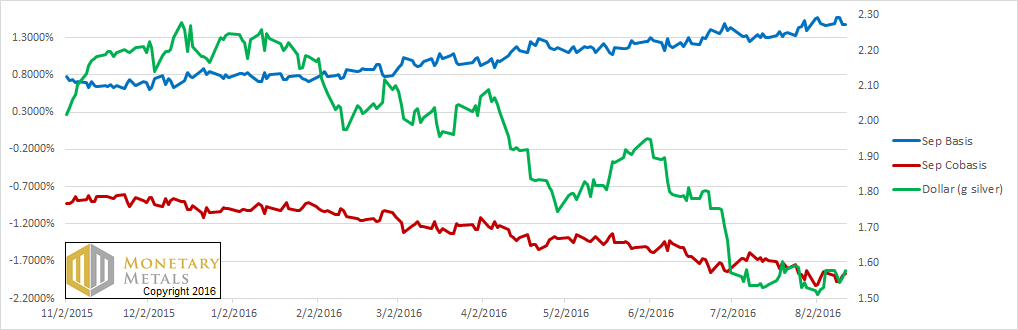

Silver basis and co-basis and the dollar priceThe same exact thing occurred in silver. Slightly growing abundance, but our model shows a slightly higher fundamental price. |

Charts by: Monetary Metals

Image caption by PT