See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Back to the Happy Place Amid a Falling Dollar The prices of the metals dropped this week, and %excerpt%.38. This could be because the asset markets have returned to their happy, happy place where every day the stock market ticks up relentlessly. Sometimes, happiness is fleeting… - Click to enlarge Dollar Bid Price The major currencies have been rising all year—we insist that this is a rise in these dollar derivatives, not a fall in the dollar—and this is a risk-on pattern. Borrow dollars, sell dollars, buy another currency to buy an asset and pocket (A) the yield of the asset, (B) the rise in price of that asset, and

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Vibhu Vikramaditya writes Navigating the Slippery Slope: How Hoover’s Interventions Paved the Way for the Great Depression

Ryan McMaken writes Frédéric Bastiat Was a Radical Opponent of War and Militarism

Douglas French writes Millennials: In Costco We Trust

Joseph T. Salerno writes What Fed “Independence” Really Means

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Back to the Happy Place Amid a Falling DollarThe prices of the metals dropped this week, $24 and $0.38. This could be because the asset markets have returned to their happy, happy place where every day the stock market ticks up relentlessly. |

|

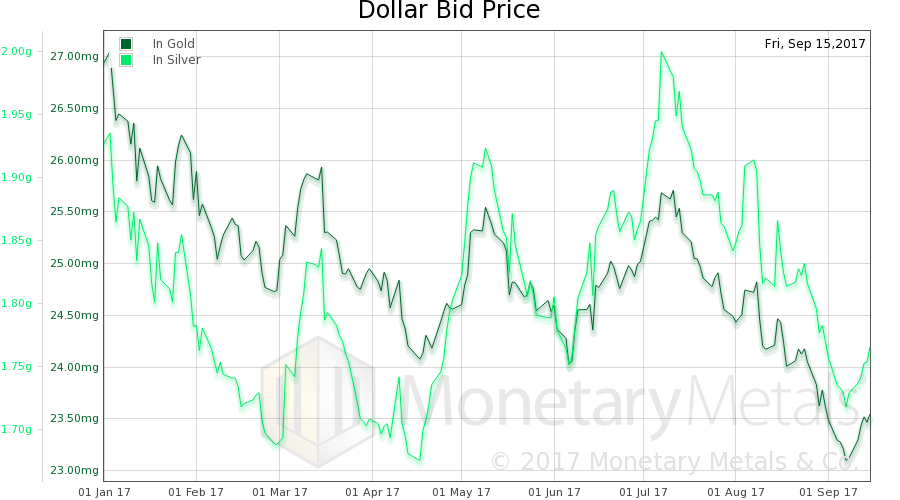

Dollar Bid PriceThe major currencies have been rising all year—we insist that this is a rise in these dollar derivatives, not a fall in the dollar—and this is a risk-on pattern. Borrow dollars, sell dollars, buy another currency to buy an asset and pocket (A) the yield of the asset, (B) the rise in price of that asset, and (C) the rise in the currency. The dollar has been falling this year. You can’t measure it in terms of its derivatives such as euro. You can measure it in terms of gold. Here is a chart, showing the drop in the dollar, from about 27 milligrams at the start of January to 23.5mg on Friday. The dollar has fallen about 13%. |

Dollar Bid Price(see more posts on dollar price, ) |

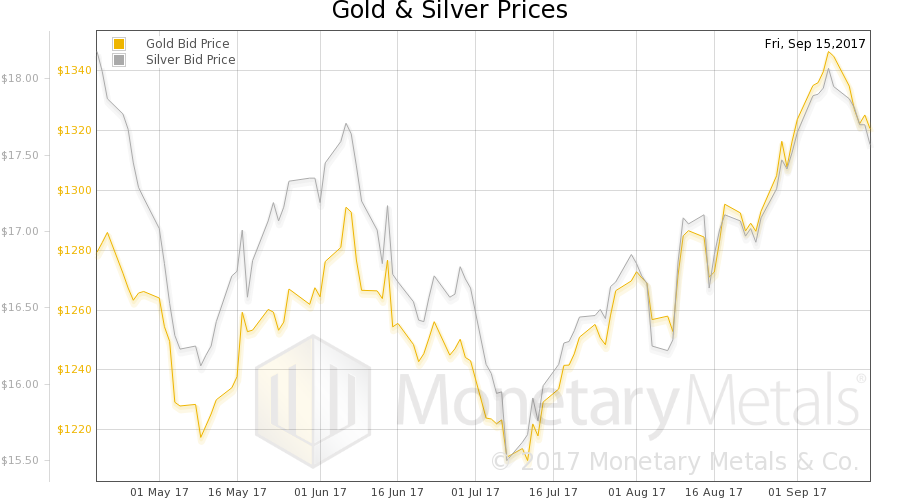

Precious Metals – Fundamental DevelopmentsWill the dollar fall further? As always, we are interested in the fundamentals of supply and demand as measured by the basis. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

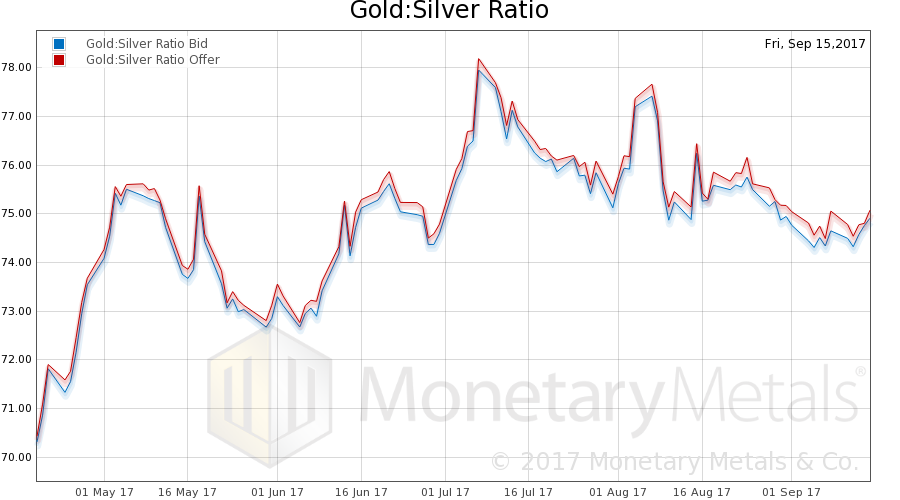

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose a bit.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

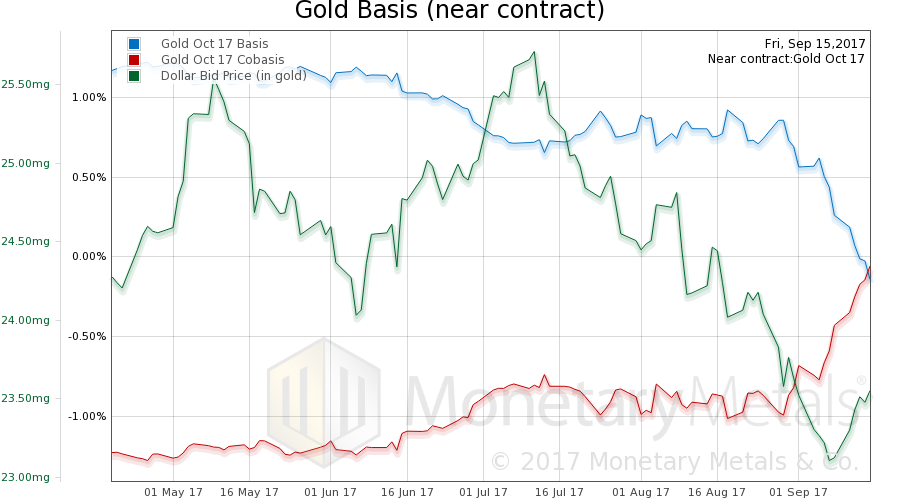

Gold Basis and Co-basis and the Dollar Price

Here is the gold graph. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

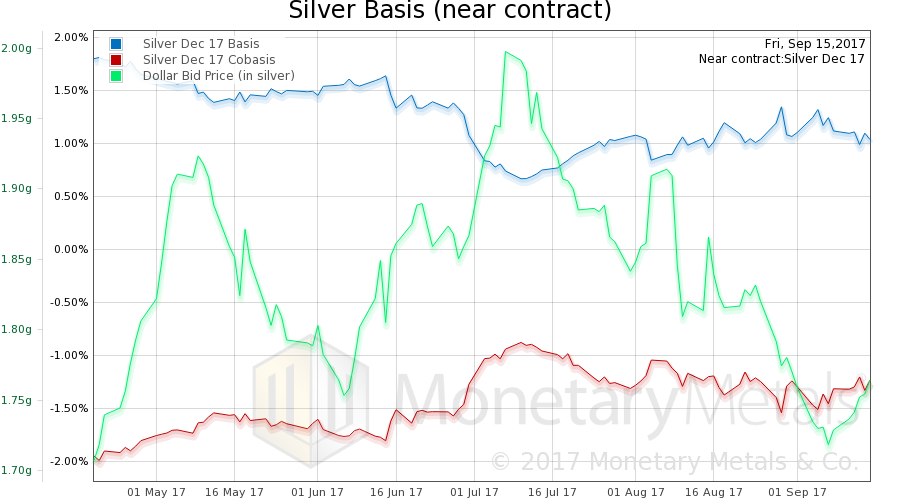

Silver Basis and Co-basis and the Dollar PriceThis is the October contract, which is under selling pressure (pushing down basis and up co-basis). This week, the moves in the basis and co-basis are due to this contract roll process (see the continuous gold basis chart here). The dollar rose somewhat (the inverse of the falling price of gold). Our calculated Monetary Metals gold fundamental price dropped $9, to $1,370. Now let’s look at silver. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

In silver, being the December contract which is farther away, it’s clearer. There was little move in the basis (around 0.07%) as the price of the dollar went up / price of silver went down.

Our calculated Monetary Metals silver fundamental price fell $0.50 to $17.38.

© 2017 Monetary Metals

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price