Europe at an Important Juncture European economic fundamentals have deteriorated rather noticeably over the past year – essentially ever since the German DAX Index topped out in January 2018. Now, European stock markets have reached an important juncture from a technical perspective. Consider the charts of the Euro-Stoxx 50 Index and the DAX shown below: Euro Stoxx 50 and DAX, DailyThe Euro-Stoxx 50 Index already peaked in early November 2017, the DAX followed suit in January 2018 – such divergent peaks are a hallmark of major turning points. The recent rally has pushed European stocks back up to trendline resistance and they are now severely overbought. - Click to enlarge According to Elliott Wave

Topics:

Pater Tenebrarum considers the following as important: 2) Swiss and European Macro, Featured, newsletter, The Stock Market

This could be interesting, too:

Vibhu Vikramaditya writes Navigating the Slippery Slope: How Hoover’s Interventions Paved the Way for the Great Depression

Ryan McMaken writes Frédéric Bastiat Was a Radical Opponent of War and Militarism

Douglas French writes Millennials: In Costco We Trust

Joseph T. Salerno writes What Fed “Independence” Really Means

Europe at an Important JunctureEuropean economic fundamentals have deteriorated rather noticeably over the past year – essentially ever since the German DAX Index topped out in January 2018. Now, European stock markets have reached an important juncture from a technical perspective. Consider the charts of the Euro-Stoxx 50 Index and the DAX shown below:

|

Euro Stoxx 50 and DAX, Daily |

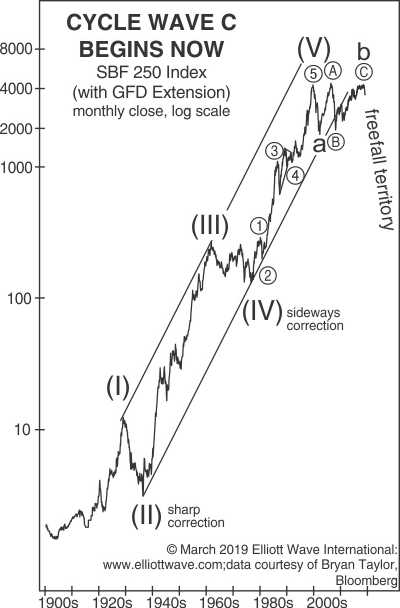

| According to Elliott Wave International’s Brian Whitmer, editor of the EWI European Financial Forecast (EFF):

Over the next four days (beginning today, March 8), readers can access the European Financial Forecast, the European Short Term Forecast and the most recent Elliott Wave Theorist for free by clicking on this link and registering at EWI (registration is not required if you are already a Club EWI member). We have read the EFF in the meantime and Mr. Whitmer has quite a few interesting things to say about European markets and European social mood trends. We would definitely encourage you to check his report out. Here is an appetizer – a chart of French stocks since the beginning of the 20th century: |

French stocks since 1900 |

Charts by: StockCharts, EWI

Tags: Featured,newsletter,The Stock Market