Gold’s Little Brother

Today I want to put a popular precious metal under the magnifying glass for you: silver.

Silver, often referred to as the “little brother” of gold, has a particularly interesting seasonal pattern I would like to share with you.

Shiny large good delivery door stops made of silver – about to enter interesting seasonal phase. PT

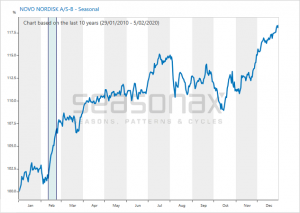

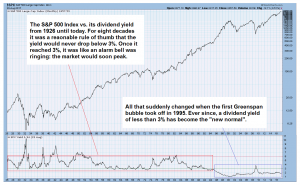

Silver’s seasonality under the magnifying glass

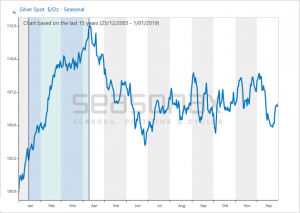

Take a look at the seasonal chart of silver. In contrast to a standard price chart, the seasonal chart shows the average pattern of silver in the course of a calendar year. For this purpose, an average was calculated from the price patterns of the past 52 years. The horizontal axis shows the time of the year, the vertical axis depicts price information.

As the chart