The Anti-Concepts of Money

The cash-value of promoting each of these anti-concepts is that they lead people to think that the central bank should impose a monetary policy. To make our lives better.

Our monetary policy is set by the Federal Reserve, which states that in pursuit of its mandate for price stability, it will engineer chronic 2% annual inflation. If we had nuclear reactor policy like this, power plant engineers would seek a slow, steady increase in core temperature. If we had airplane policy, pilots would want a slow, steady loss of altitude.

The purpose of monetary policy is to boost GDP and employment. So long as it does not reduce purchasing power too rapidly, i.e. cause too much inflation, and of course if actually boosts GDP and employment and

Articles by Keith Weiner

Reflections Over 2022

January 2, 2023The life of an entrepreneur is not what most people would call “normal”. I don’t refer to the guy who buys a fast-food franchise. Nor to the gal who builds a chain of hair salons. Nor to the folks who have law or accounting firms. These are all entrepreneurship. I don’t know a lot about how these businesses work, but I do know one thing. They should reach cash-flow positive very quickly; if not, something is wrong. And most of them reach their capacity fairly quickly too. They do not have the open-ended upside of a global corporation. Nor the ever-looming possibility of utter failure.

I refer to the entrepreneur who starts something Big (something like 3D voice or a gold monetary system). And the challenge is that Big things necessarily have to get… well… big.

Silver Fever, or Silver Fading?

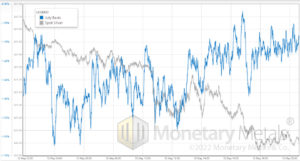

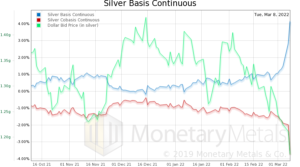

September 16, 2022We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. 😉

Silver Basis and the Dollar

This graph goes back one year, through September 1. We ended on this date, because it’s the highest price of the dollar along with the greatest scarcity of silver. Notice the red line going over zero. This is notable, as the 6-month continuous basis seldom goes into backwardation (our definition is stricter than most, backwardation is when

The Russians (Propaganda) Are Coming!

September 15, 2022The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh?

Not so fast.

Betting Against the Incumbent?

For one thing, there are sanctions. If you’re a citizen of a Western country, there is a legal barrier between you and a brokerage account in Moscow. And even if you’re not, Russia has capital controls. Who would send their gold and cash there? Russia is a net exporter of gold; gold is always leaving the country anyways.

Leaving that aside, let’s look at the economic problem before we get to the actual news under the

Silver Update: Scarcity Gets More Extreme

September 5, 2022Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading.

Warren Buffett, 2008, and the Cobasis

But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis.

It shows a measure of gold’s abundance to silver’s abundance, and gold’s scarcity to silver’s scarcity. When the blue line is above 1, it means the gold basis is higher, which means gold is more abundant. When the red line is below, it means gold is less scarce.

.

The blue line is not merely above 1. It is now above the spike in

The Silver Phoenix Market

September 2, 2022Listen to the audio version of this article here.

The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks.

Breaking Down Fundamental Silver Prices

However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price.

The market price is down a lot since that peak, but the fundamental price has moved sideways (ignoring the two spurious drops) and is now the same as on March 8.

.

Now let’s look at what the silver basis and silver cobasis are showing.

There has been a big run up in the cobasis (i.e. the measure of scarcity), since August 8. It has hit

Buy Gold, Because…

August 11, 2022The coin which helped win the gold vs bitcoin debate at the Soho Forum Photo credit: the author

It’s pretty, isn’t it?

Gold, Liquid Gold, and Inflation

Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. It’s just an inch and a quarter in diameter yet weighs 0.075 pounds. Everyone should hold one in his hand (and own a few).

But that’s not why many gold analysts today are saying you should buy gold. They are saying it will protect you from inflation. And the Keynesians and bitcoiners are smirking that gold is not, in fact, protecting you from inflation.

“Look at how much prices have risen,” they gloat. “Gold hasn’t gone up nearly as much as gasoline,” they practically smirk.

It would be tempting to unlimber the Tu

What the Heck Is Happening to Silver?!

July 20, 2022The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%.

As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis.

JP Morgan and Motte and Bailey

JP Morgan’s manipulation of gold and silver prices is the focus of discussion in the gold community again, as another criminal trial is now underway, this time the accused is the former head of precious metals trading at the bank (we have discussed the manipulation conspiracy theory here and here).

Central to this trial—and the

Rare Gold-Silver Crystal Sighting

July 8, 2022Something has happened which has not occurred since 2009. The silver basis—our measure of abundance of the metal to the market—has gone way under the gold basis. This means silver is less abundant to the market than gold. Here is the picture.

The blue line is the ratio of the gold basis to the silver basis (and red is the ratio of the gold cobasis—scarcity—to the silver cobasis).

This condition has not occurred in recent years, because the trend has been a rising gold-silver ratio. That is, silver has been generally falling as measured in gold terms. The reason is that there has been no lack of sellers coming to market). Selling physical metal pushes down the bid on the spot price.

Cobasis = spot(bid) – future(ask)

In other words, selling physical metal tends to

Will Interest Rate Hikes Fix Inflation?

June 19, 2022Senator Elizabeth Warren and President Joe Biden claim that inflation[i] is caused by greedy corporations. And they propose to solve this problem by making the corporations pay. Whether it’s extracting a “windfall profits” tax, crushing them under even more regulation, or attacking them with antitrust enforcement, the idea is the same. They propose to harm the corporations which produce the things we need such as energy and food, which will somehow cause prices to drop. They think that hurting producers will do good to consumers.

Think about this. Take as long as you need.

This kind of blatant zero-sum, win-lose view is the essence of socialism. It may be popular among the Left, but fortunately it is outside the mainstream.

The Quantity Theory of Money is Dead

The Silver Chart THEY Don’t Want You to See!

May 16, 2022On Thursday May 12, the price of silver fell about a buck. As with every one of these big price moves, the question is: what really happened? Below is a chart of the day’s action, with price overlaid with basis. Basis = future – spot. It is a great (i.e. the only) indicator of abundance or scarcity of metal to the market. However, here we are using it for a different, simpler purpose. We want to see the relative moves in the spot price and the near futures contract price (i.e. July).

The day was mixed. Before noon (times are GMT), the basis is volatile but tends to fall with the falling price. The basis drops from around -1.1% to -1.5%. But after noon, something changed.

We see falling price and rising basis. The basis tends to follow the shape of the price line,

Forensic Analysis of Fed Action on Silver Price

May 9, 2022The last few days of trading in silver have been a wild ride.

On Wednesday morning in New York, six hours before the Fed was to announce its interest rate hike, the price of silver began to drop. It went from around $22.65 to a low of $22.25 before recovering about 20 cents.

At 2pm (NY time), the Fed made the announcement. The price had already begun spiking higher for about two minutes.

As an aside, we wonder a bit about how they keep privileged traders from peeking at such announcements before the rest of the world gets to see it.

If there was not central planning which ruled our fates with its every edict, this issue would not exist.

Anyways, the price moved up 23 cents by 2:05. It moved sideways waiting for the Fed press conference. Within 11 minutes of the

Time for a Silver Trade?

May 4, 2022The price of silver has been going down, and then down some more. From over $28 a year ago, and over $26.50 a month ago, it’s now at a new low under $22.50. Four bucks down in a month.

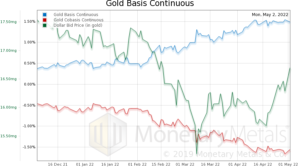

However, it’s been behaving differently than gold behind the scenes. Let’s look at the gold and silver basis charts to see.

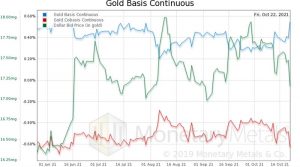

Gold Fundamentals – Gold Basis Analysis

The gold basis (i.e. abundance to the market) was humming along around 0.5%. Then, as the price began to rise, it rose also, now around 1.5%. Gold would seem to be more abundant, first with a higher price (inverse to the price of the dollar, as measured in gold, indicated on the chart). Now, the gold basis is showing that it still looks abundant, even at a lower price.

.

Now look at silver.

Silver Fundamentals – Silver

Oil, the Ruble and Gold Walk into a Bar…Part III

April 12, 2022Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else?

What A Gold Standard Isn’t

Can we all recognize the simple fact that every government price-fixing scheme, ever, has failed?

For example, banana republics have declared their pesos to be worth $1. But when the market decides to redeem pesos for dollars 1-to-1, the central bank abandons the peg. A less-understood example is when the Swiss National Bank decided to hold its franc down to €0.77. It boasted it could print as many francs as necessary to keep the franc down. But it hit its stop-loss limit, and was forced to abandon this peg just like all the banana

Oil, the Ruble, and Gold Walk into a Bar…

April 5, 2022[unable to retrieve full-text content]Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause rain.”

Read More »Keith Weiner on the Gold Market and How to Replace Government Paper Money

April 4, 2022Keith Weiner is founder and CEO of Monetary Metals, an investment firm that pays interest on gold, and the founder of the Gold Standard Institute USA. Weiner’s mission is to provide entrepreneurial services and education to help restore gold as the world’s money par excellence.

Mentioned in the Episode and Other Links of Interest:

The YouTube version of this interview

Keith Weiner’s bio at Monetary Metals

Weiner’s Forbes article on gold and silver coins not circulating

?For more information, see BobMurphyShow.com. The Bob Murphy Show is also available on Apple Podcasts, Google Podcasts, Stitcher, Spotify, and via RSS.

Powered by WPeMatico

[embedded content]

You Might Also Like

Keith

Read More »Human Action in the Silver Market

March 29, 2022Sorry, I’ve looked everywhere but I can’t find the page you’re looking for.

If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page:

Search

Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dweiner+human+action+silver+market …

Read More »Ukraine and the Next Wave of Inflation, Part II, Can Russia Enact a Gold Standard?

March 13, 2022Can Russia Enact a Gold Standard?

In Part I we discussed how the fallout from the Russian invasion of Ukraine will lead to inflation, but not in the way most people think. In Part II we discuss the possibility of Russia repudiating the dollar and going on a gold standard. Can they do it? How would the world react? Why not enact a Bitcoin Standard instead?

The Russian central bank reportedly has over 2,000 tonnes of gold. We have seen three arguments repeated many times, both in finance/economic articles and on social media.

One is that Russia can pay gold for goods, to work around being locked out of the SWIFT payments system.

Two is that Russia could use this to declare a gold standard, which would really piss off the Western powers.

Three is that a number of

This is Not The Silver Breakout You’re Looking For!

March 10, 2022To listen to the audio version of this article click here.

Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Oh well. Our consolation is that they most likely are not calling for lower silver prices based on the same indicator we observe.

The basis.

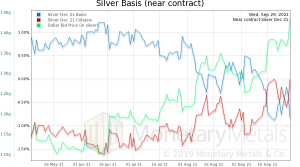

Here is the chart.

Silver Price Basis Chart

Look at that moonshot!

basis = future(bid) – spot(offer)

cobasis = spot(bid) – future(offer)

As the price has risen since February 25, from under $24, to yesterday around $27, the silver basis shot up. It went from 0.67% to 4.18%.

.

Silver Buyer Beware

Folks, it does not get any clearer than this. The

Reflections Over 2021

January 13, 2022In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices.

At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments. One, the UK government forces you to get a Covid test to visit the country and the US government forces you to get another test to be allowed to board a flight back home. Yes, even US citizens. No, I do not think this is constitutional (but who cares about that old document).

Two, by the way, having a stick jammed up your

The Zombie Ship of Theseus

January 4, 2022To listen to the audio version of this article click here.

The Ship of Theseus is an old philosophical thought experiment. It asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship?

We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system. The additional element is what if the replacement boards are adulterated in some way. That is, each new board is warped, or weakened, or otherwise not fit for purpose.

It should be clear that replacing boards with unsound wood does not alter reality, only the ship. It does not remove any constraints such as the need to be watertight. It does not make anything better, only

Inflation and Gold: What Gives?

December 21, 2021Listen to the audio version of this article here!

In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the:

“…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.”

Since then, Ireland has bought gold for the first time in over a decade. And predictably, most voices in the gold community see this as a bullish sign.

By the way, we did not see any data about the prices paid on what dates, but the articles on December 1 mention a series of buys over a few months. Assuming a few means two, it looks like Ireland may have paid more than the current price.

The Different Theories on

What’s In Your Loan?

November 29, 2021Opposing Monetary Directions

“Real estate is the future of the monetary system,” declares a real estate bug.

Does this make any sense? We would ask him this.

“OK how will houses be borrowed and lent?”

“Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

“What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”

“Yes, but housing is the collateral.”

OK, so it’s not a housing bond. It’s a dollar bond used to finance the purchase of houses. These are not the same thing at all, the way chalk and cheese are not the same thing, despite both being single-syllable words beginning with the letters “ch”.

El Salvador’s Bitcoin Gamble

A few weeks back, we looked at the investor’s

What’s In Your Loan?

November 23, 2021To listen to the audio version of this article click here

Opposing Monetary Directions

“Real estate is the future of the monetary system,” declares a real estate bug.

Does this make any sense? We would ask him this.

“OK how will houses be borrowed and lent?”

“Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

“What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”

“Yes, but housing is the collateral.”

OK, so it’s not a housing bond. It’s a dollar bond used to finance the purchase of houses. These are not the same thing at all, the way chalk and cheese are not the same thing, despite both being single-syllable words beginning with the letters “ch”.

El Salvador’s

Perversity Thy Name is Dollar

November 16, 2021[unable to retrieve full-text content]Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

Read More »Rising Fundamentals of Gold and Silver

November 10, 2021[unable to retrieve full-text content] Prices move up and down, in the restless churn of our irredeemable monetary system. There are several schools of thought whose theories attempt to describe, if not predict, the next price move.

Read More »Why a Yield on Gold Matters

November 3, 2021Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold.

What Happened to Gold After the Gold Standard?

It is difficult to picture because it is so different from the world of 2021. In our world, the government first established a central bank in 1913, then prohibited gold ownership and voided all gold contract clauses in 1933. It finally severed the tie between gold and its official currency, in 1971. It

Why Isn’t Gold Going Up with Inflation?

October 26, 2021Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation—shared by Keynesians, Monetarists, and many Austrians—is that the cause of this skyrocketing is the increase in the quantity of what is called “money”.

The price of gold has not been going up. The inference is that it should be going up (note the word “should” is very dangerous in trading). The default assumption is there can only be one possible explanation: price suppression. We aren’t going to debunk, yet again, this conspiracy theory. Our definitive proof is in our response to Ted Butler. Nor address, yet again, the fact that the dollar is not money, nor is it an objective measure of the

Transitory Inflation and Useless Ingredients

October 5, 2021Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…)

Anyways, it’s normal to grow out of this naïve view of television. No one believes it past the age of eight, much less into adulthood.

Purchasing Power and Intrinsicism

This is a simple instance of the philosophic concept of intrinsicism. To think of external characteristics as if they are inside or an integral part of an object. Actors are not inside the TV, nor are video production studios. Not even the content is inside the TV. The TV is nothing more than a medium to render video.

You

Silver Crash Makes Silver Trash?

October 1, 2021The price of silver dropped a dollar, or over 4% on Wednesday. Some voices in the precious metals press want you to think that there is only one conceivable cause. We should coin a term for this form of logical fallacy: argumentum ad ignorantia. This is an argument of the form: “the cause must be XYZ, as I cannot conceive of anything else.”

The Same Old Song and Dance

In this case, XYZ is that the alleged cartel, the bullion banks and/or central banks, sold silver futures in mass quantity. Also, allegedly, inflation-fearing masses are buying physical gold.

What would happen if the price of futures were pushed down, while the price of physical were pushed up? We will be charitable, and say that physical only went up a penny. Let’s give a hint:

Basis = future – spot