Ridiculous Minutia Jerome Powell, the new Chairman of the Federal Reserve, just completed his third week on the job. He’s hardly had enough time to learn how to operate the office coffee maker, let alone the all-in-one printer. He still doesn’t know what roach coach menu items induce a heinous gut bomb. Photo credit: A. Brandon / AP - Click to enlarge The perpetually slightly worried looking new Fed chairman...

Read More »“Strong Dollar”, “Weak Dollar” – What About a Gold-Backed Dollar?

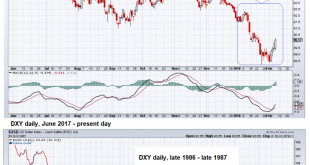

Contradictory Palaver The recent hullabaloo among President Trump’s top monetary officials about the Administration’s “dollar policy” is just the start of what will likely be the first of many contradictory pronouncements and reversals which will take place in the coming months and years as the world’s reserve currency continues to be compromised. So far, the Greenback has had its worst start since 1987, the year of...

Read More »The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname. One fable has it where the goddess’s sacred...

Read More »The Donald Saves the Dollar

Something for Nothing The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon. Looking at the expression of this Mickey’s Malt Liquor tester one might...

Read More »The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

FOMC Strategy Revisited As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. The rate hikes are actually leading somewhere – after the Wile E. Coyote moment, the FOMC meeting strategy is especially useful - Click to enlarge A study published by the Federal Reserve Bank of New York in 2011 examined the effect of...

Read More »As the Controlled Inflation Scheme Rolls On

Controlled Inflation American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come. After an extended period of indulging in excessive moderation (left), the US consumer makes his innermost wishes known (right). - Click to enlarge On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to...

Read More »If Bitcoin Is A Bubble…

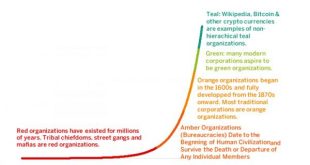

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Why Monetary Policy Will Cancel Out Fiscal Policy

Remarkable and Extraordinary Growth Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas? Here’s what really happened: the government’s minions confiscated everything Santa had on him when he crossed the border and then added it to GDP. - Click to...

Read More »Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org