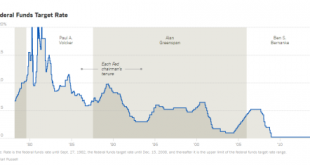

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

Read More »Their Gap Is Closed, Ours Still Needs To Be

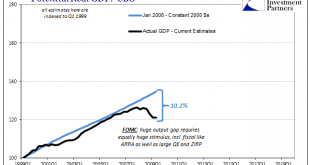

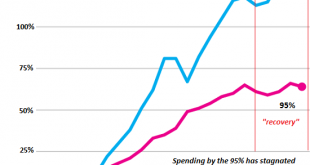

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

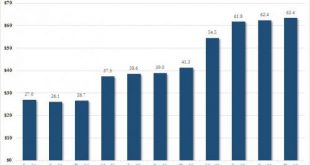

Read More »Swiss National Bank’s U.S. Stock Holdings Hit A Record $63.4 Billion

Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that. In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year....

Read More »Incrementum Advisory Board Meeting, Q1 2017 and Some Additional Reflections

Looming Currency and Liquidity Problems The quarterly meeting of the Incrementum Advisory Board was held on January 11, approximately one month ago. A download link to a PDF document containing the full transcript including charts an be found at the end of this post. As always, a broad range of topics was discussed; although some time has passed since the meeting, all these issues remain relevant. Our comments below...

Read More »The Central Banks Pull Back: Now It’s Up to Fiscal Policy to “Save the World”

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank “save” has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy?...

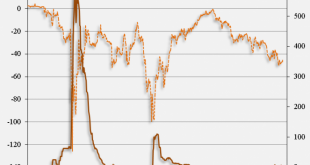

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

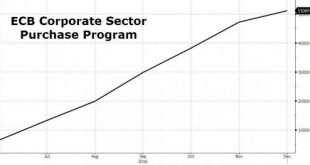

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org