Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved...

Read More »Stupid is What Stupid Does – Secular Stagnation Redux

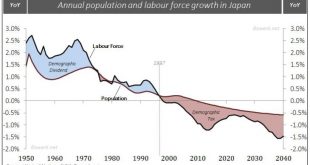

Annual population and labour force growth in Japan Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking...

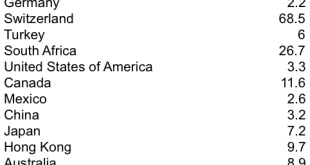

Read More »UK Imported Net 152 Tonnes of Gold in June, 68 from Switzerland

On a firmly rising gold price the UK is one of the largest net importers of gold in 2016. The gold price went up 25 % from $1,061.5 dollars per troy ounce on January 1 to $1,325.8 on June 31. Over this period the UK net imported 583 tonnes and GLD inventory mushroomed by 308 tonnes. In the month of June the UK gross imported 154.2 tonnes, up 22 % from May, and gross export was 1.9 tonnes, down 37 % from the previous...

Read More »Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller. Corporate and government debt have been soaring for years, but investor appetite for such debt has evidently grown even more. A huge mountain of interest-free risk has...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his...

Read More »Best Countries To Store Gold (How Did America, A Serial Defaulter, Make The Cut?)

Submitted by Peter Diekmeyer via SprottMoney.com, An era of slowing growth, falling corporate profits, record debt levels, and currency debauchment has many investors buying gold as a bet against global central banks. Holding that gold outside the banking system, and for some, outside one’s own country, are increasingly popular options. Canada, Switzerland, and four other countries have particularly attractive...

Read More »Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Negative Consumer Financing Rates in Germany Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one’s means. Curiously, it was just a month ago when an...

Read More »Jailing Banksters Will Not Resolve the Economic Crisis

Meet the Scapegoats Last week, an Irish court sentenced three prominent banksters for their roles in the 2008 financial crisis. Judge Martin Nolan, who pronounced judgment, said that the bansksters had committed “a very serious crime.” He continued: “The public is entitled to rely on the probity of blue chip firms. If we can’t rely on the probity of these banks we lose all hope or trust in institutions.”* Meet the...

Read More »Greenspan explains negative Swiss Yields

Jeff Gundlach is not the only person who is feeling “maximum negative” on Treasuries. In an interview, none other than the “Maestro” Alan Greenspan, the man whose “great moderation” policy made the current global bond bubble possible, said that he is worried bond prices have risen too high. Asked if he finds what is happened in the bond market right now “in any way, shape, or form concerning for financial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org