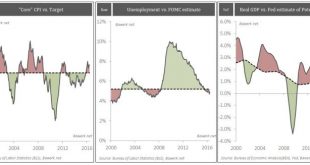

Imagine the financial crisis knocked you out and you did not wake up from the coma that followed until this day. Then, presented with the following three charts you were asked to guess where the federal funds rate was trading. Given the fact that the core CPI is on a steep uptrend and currently over the arbitrarily set 2 per cent target; unemployment below what the FOMC regards as full employment and; GDP running at a...

Read More »Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today’s uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of “helicopter money” is about to be unveiled in Japan by the world’s most experimental central bank. However, as Nomura’s Richard Koo warns, central banks may get much more than they bargained for, because helicopter money “probably marks the end of the road for believers in the omnipotence of monetary policy who have...

Read More »Claudio Grass Interviews Ronald Stoeferle: Central Banks In A Lose-Lose Situation

A Fragile System Claudio Grass, Global Gold: Ronald, it is a pleasure to have the opportunity to speak with you. We’ve known each other for a very long time, both on a personal and professional level. Because of our central banks, we find our economies today operating on artificial stimulus and negative interest rates. How would you summarize the consequences of this policy? Mr. Stoeferle: I have always considered...

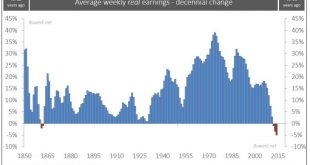

Read More »Unsound Money Has Destroyed the Middle Class

Duped and Distorted DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal. You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane....

Read More »The Real Reason the “Rich Get Richer”

Time the Taskmaster DUBLIN – “Today’s money,” says economist George Gilder, “tries to cheat time. And you can’t do that.” It may not cheat time, but it cheats far easier marks – consumers, investors, and entrepreneurs. It took us a moment to understand what Gilder meant. Then we realized he’s right. Time is the ultimate limitation… the ultimate truth… the ultimate fact. You’ll recall. There are facts and there are...

Read More »The World’s Central Banks Are Making A Big Mistake

Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »Bank of Japan: Destination Mars

Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this is now standard operating procedure. For example, in Japan this explicit intervention into the...

Read More »Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

Read More »Helping Robots Find Jobs…

Meaningless Noise BALTIMORE – The Dow rose 250 points on Friday… putting it back near its all-time high. A “blow-out jobs report” was said to be the inspiration. Oh my… so many dots.. so little time. Friday’s jobs report said that 278,000 Americans found work in June – up from 11,000 in May. This was considered such good news that investors rushed to buy stocks. At least, that was the line taken by the mainstream...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org