Overview: Corrective pressures were evident yesterday and they extended today in Asia and Europe but seem to be running their course now. Market participants should view these developments as countertrend and be wary of waning risk appetites in North America today. Most Asia Pacific equities rallied earlier today, save China and Hong Kong. Europe’s Stoxx 600 has retraced most of yesterday’s losses and US futures are trading higher. Benchmark bond yields are softer...

Read More »Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?” Sherlock Holmes: “To the curious incident of the dog in the night-time.” Gregory: “The dog did nothing in the night-time.” Sherlock Holmes: “That was the curious incident.” From Silver Blaze by Arthur Conan Doyle, 1892 It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason”...

Read More »The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk. What we have seen among some central bankers applies to market...

Read More »Jackson Hole and More

Overview: Ahead of the much-anticipated speech by Federal Reserve Chair Powell, the Fed funds futures are pricing in about a 70% chance of a 75 bp hike next month. The US 10-year yield is up nearly five basis points today to 3.07% and the two-year yield is firm at 3.38%. Asia Pacific equities were mostly higher, with China the main exception among the large markets, after US equities rallied yesterday. Europe’s Stoxx 600 is off about 0.3% to bring this week’s...

Read More »Dollar Longs Pared as Jackson Hole Gathering is set to Start

Overview: It seems that many market participants had the same thing in mind, cut dollar longs before the Jackson Hole gathering. The Antipodeans lead the majors move, encouraged perhaps by China’s new economic measures, with around a 1% gain. The euro and sterling are up about 0.35% and are the laggards. Emerging market currencies are higher as well, with the notable exception of India and Turkey, which are nursing small losses. Equities are having a good day. All...

Read More »No Relief for the Euro or Sterling

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors. The European currencies have suffered the most, except the Norwegian krone. The dollar-bloc and yen are also slightly firmer. The week has begun off with a risk-off bias. Nearly all the large Asia Pacific equity markets were sold. Chinese...

Read More »Flash PMI, Jackson Hole, and the Price Action

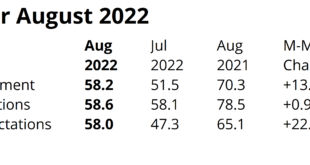

For many, this will be the last week of the summer. However, in an unusual twist of the calendar, the US August employment report will be released on September 2, the end of the following week, rather than after the US Labor Day holiday (September 5). The main economic report of the week ahead will be the preliminary estimate of the August PMI. The policy implications are not as obvious as they may seem. For example, in July, the eurozone composite PMI slipped...

Read More »The Dollar is on Fire

Overview: The dollar is on fire. It is rising against all the major currencies and cutting through key technical levels like a hot knife in butter. The Canadian dollar is the strongest of the majors this week, which often outperforms on the crosses in a strong US dollar environment. It is off 1.5% this week. The New Zealand dollar, where the RBNZ hiked rates this week by 50 bp, is off the most with a 3.5% drop. Emerging market currencies are mostly lower on the...

Read More »Fed Minutes were Not as Dovish as Initially Read

Overview: The sell-off in European bonds continues today. The 10-year German Bund yield is around four basis points higher to bring the three-day increase to about 22 bp. The Italian premium over Germany has risen by almost 18 bp over these three sessions. Its two-year premium is widening for the fifth consecutive session and is above 90 bp for the first time in almost three weeks. The 10-year US Treasury yield is a little softer near 2.88%. Most of the large Asia...

Read More »China Disappoints and Surprises with Rate Cut

Overview: Equities were mostly higher in the Asia Pacific region, though Chinese and Hong Kong markets eased, and South Korea and India were closed for national holidays. Despite new Chinese exercises off the coast of Taiwan following another US congressional visit, Taiwan’s Taiex gained almost 0.85%. Europe’s Stoxx 600 is advancing for the fourth consecutive session, while US futures are paring the pre-weekend rally. Following disappointing data and a surprise cut...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org