What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business. So, no, I don’t know what’s going to happen this year. I do know what the consensus view is, what the majority expects to happen, and that may be more useful. Because...

Read More »Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed. Yes, 2008. Also everything after. The Chinese have followed closely this style having realized what took Bernanke too long. That is, the...

Read More »Synchronizing Chinese Prices (and consequences)

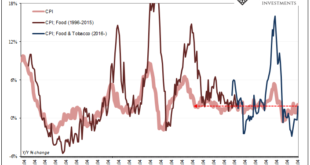

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »Who’s Playing Puppetmaster, And Who Is Master of Puppets

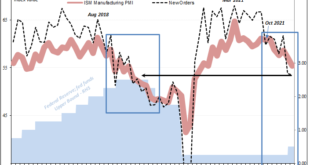

Cue up the old VHS tapes of Bill Clinton. The former President was renowned for displaying, anyway, great empathy. He famously said in October 1992, weeks before the election that would bring him to the White House, “I feel your pain.” What pain? As Clinton’s chief political advisor later clarified, “it’s the economy stupid.” Jay Powell is no retail politician in near the same company as Mr. Clinton. Yet, the Federal Reserve’s current Chairman is attempting to...

Read More »Collateral Shortage…From *A* Fed Perspective

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods. There was, as I wrote...

Read More »What Really ‘Raises’ The Rising ‘Dollar’

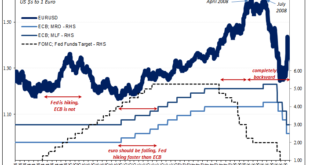

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

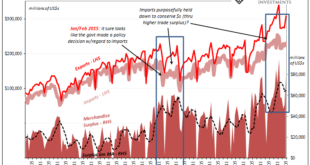

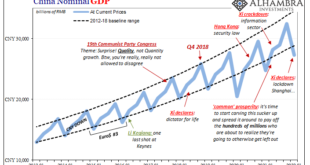

Read More »The (less) Dollars Behind Xi’s Shanghai of Shanghai

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth. Xi Jinping saw how a very different post-2008 global economy without any recovery was going to...

Read More »So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened. Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what...

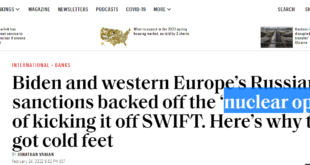

Read More »SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business. From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. Thus,...

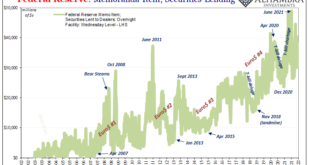

Read More »Sentiment v. Substance: Checking In On Collateral Via, Yes, The Fed

The Federal Reserve, like other central banks around the world, it does lend out the securities it owns and holds. Sophisticated modern wholesale money markets are highly collateralized, so much so that collateral itself takes on the properties of currency. Elasticity of collateral is as much – if not more – important as elasticity of other forms of wholesale money (therefore excluding bank reserves). Dealers, however, they don’t much like using the Fed’s Securities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org