Overview: The dollar's sell-off last week was extreme and it recovered yesterday and through the European session today. The Australian dollar has been hit the hardest. It is off more than 1% today after the RBA lifted the cash rate by 25 bp (to 4.35%). Still, the US dollar's gains have stretched intraday momentum indicators, suggesting the upside correction may be nearly over. The greenback's moves appear to have been driven by interest rate expectations. Recall...

Read More »US Yields and Dollar Rise After US Government Closure Averted

Overview: The US avoided a government shutdown, barely, and this eased one of the headwinds that were anticipated. In turn, this is spurring new gains in US interest rates and helping underpin the dollar at the start of the new quarter. The 10-year Treasury is holding above 4.60% and nearing last week's high (4.68%). The two-year yield gapped higher and is near 5.10%. The high from September 21 was almost 5.20%. The Swiss franc is the only G10 currency holding its...

Read More »China Steps away from the Abyss and Animal Spirits are Rekindled

Overview: Chinese officials using the carrot and the stick have succeeded in dampening the protests and easing some anxiety and rekindled the animal spirits. Hong Kong’s Hang Seng rallied 5.25% and its index of mainland shares surged 6.20%. South Korea and Taiwan indices gained more than 1%. Among the large bourses, only Japan failed to advance. Softer than expected Spanish and German inflation may also be helping the Stoxx 600 recoup around half of yesterday’s...

Read More »Markets are Less on Edge as the Darkest Scenarios seem Less Likely

Overview: The situation in central Europe is still intense but it appears top US, European and Polish officials are more reluctant than some market participants to attribute the darkest of intentions and paint extreme narratives. The Polish zloty has recovered around 1.3% today and other central European currencies are also trading firmer to lead the emerging market currencies. The US dollar is broadly weaker against the G10 currencies. The large Asia Pacific bourses...

Read More »Spanish Inflation Shocks

Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today. The three-day rally in Europe’s Stoxx 600 is being snapped today. US futures are posting small losses. The US 10-year yield is little changed around 3.17%, while European benchmarks are narrowly mixed, with the periphery doing better than the core. The dollar is enjoying a firmer...

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

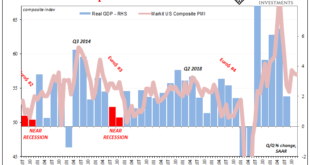

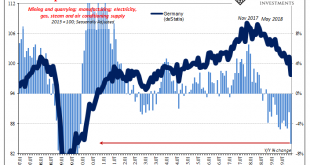

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

Swiss Franc The Euro has fallen by 0.45% to 1.0751 EUR/CHF and USD/CHF, September 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week’s gains. The Dow Jones Stoxx 600 is off...

Read More »As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other...

Read More »FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.0932 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July...

Read More »FX Daily, April 29: The Busy Week Begins Slowly

Swiss Franc The Euro has risen by 0.15% at 1.1386 EUR/CHF and USD/CHF, April 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It promises to be an eventful week with the FOMC and BOE meeting, US jobs report and EMU April CPI and Q1 GDP on tap. However, the week is marked by the May Day holiday in the middle of the week. Japan’s markets are closed all week, while...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org