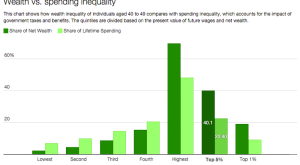

In a New Republic blog, Alan Auerbach and Larry Kotlikoff discuss lifetime spending inequality. Due to taxes and income variability over the life cycle, this is much smaller than wealth or income inequality. Auerbach and Kotlikoff write: The top 1 percent of 40-49 year-olds face a net tax, on average, of 45 percent. … For the bottom 20 percent, the average net tax rate is negative 34.2 percent. … Our standard means of judging whether a household is rich or poor is based on current income....

Read More »US monetary policy: a second rate hike in June remains the most likely scenario

The FOMC sounded quite cautious and surprised at its meeting yesterday as it markedly revised down its Fed funds rate median projection for the end of this year. As widely expected, at yesterday’s FOMC meeting, the Fed chose to ‘stand pat’. Although yesterday's FOMC meeting was perceived as sounding ‘dovish’ and Fed funds rate projections were cut, the Fed still expects to hike at least twice this year. On our side, we continue to look for two rate hikes this year, the first probably in...

Read More »United States: core PCE inflation picked up markedly in January

As widely expected, core PCE inflation picked up further in January, but the increase was surprisingly pronounced. However, we do not expect much more upside over the rest of the year. In Friday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. Following higher-than-expected CPI numbers the week before, a relatively marked monthly increase was also expected last Friday. However, the...

Read More »United States: we remain optimistic on consumption growth in 2016

Today’s retail sales report was reassuring. We remain sanguine on consumption growth in 2016. Unsurprisingly, Fed Chair Yellen acknowledged the downside risks to the growth outlook but did not rule out a hike in March. Nominal total retail sales rose by 0.2% m-o-m in January, slightly above consensus expectations (+0.1%). Moreover, December’s number was revised up from -0.1% to +0.2%. Total sales were dented by a 3.1% m-o-m fall in nominal sales at gasoline stations (on the back of lower...

Read More »United States: the ISM Non-Manufacturing index fell further markedly in January

The US ISM Manufacturing index remained stuck at quite low levels and the Non-Manufacturing index declined further heavily. However, it remained pitched at a still relatively healthy level. The ISM Manufacturing index stabilised at a low level in January. But its Non-Manufacturing counterpart fell further heavily, although it remained pitched at a still relatively healthy level. Nevertheless, together with most other economic data published recently, these surveys unfortunately confirm...

Read More »United States: soft growth in Q4, but a serious downturn remains unlikely

The economy ended last year with soft momentum, and the sharp tightening in US financial and monetary conditions will undoubtedly weigh on US economic growth over the coming months. However, we remain upbeat about consumption and the housing sector. US real GDP, curbed by lower stockbuilding and a slowdown in consumption growth, grew by a soft 0.7% in Q4. We have cut our forecast for 2016. However, we still expect reasonably healthy growth (2.0%). In Q4 2015, US real GDP grew by a weak...

Read More »Oil’s Turbulent New Year

The beginning of a new year is supposed to be a time to start fresh, but for oil markets, 2016 has brought only fresh troubles. On January 6, the U.S. Energy Information Administration announced that at 482.3 million barrels, U.S. crude oil inventories are close to an 80-year-high for this time of year. As if that weren’t enough, concerns about global economic growth, sparked by another month of weak Chinese manufacturing data, triggered a widespread selloff in global financial markets last...

Read More »US Consumers Are on a Shopping Spree

Real GDP growth in the U.S. wasn’t particularly impressive in the third quarter –the 1.5 percent annualized increase came in just shy of the 1.6 percent consensus forecast and way down from the 3.9 percent reading in the second quarter. A look at the components of GDP growth, however, reveals a very positive signal for the future: Consumer spending has been the biggest contributor to GDP in recent quarters, and American consumers are spending enough to make up for stagnating exports and...

Read More »Global Wealth and the Long-Term Investor

How wealthy has China become? At last count, the country accounted for a full 8 percent of all global ultra-high net worth investors—those worth more than $50 million. What will those UHNWIs do with that newfound wealth? That’s an important question, because household wealth is a key driver of consumers’ consumption and investment decisions as well as entrepreneurial activity, and that holds true whether one is Chinese, American, or otherwise. China and the United States led the...

Read More »The Big Three of the TPP

On October 5, after 10 years of negotiations, 12 Pacific Rim countries that account for a combined 40 percent of global GDP agreed to a sweeping trade deal called the Trans-Pacific Partnership (TPP). The final text of the agreement isn’t public yet, but it appears that it would eliminate a large number of tariffs on goods and services, require state-owned enterprises to obey international trade laws, set stricter environmental and labor standards, and establish international tribunals to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org