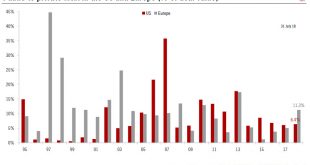

Despite a disappointing equity market performance this year, M&A activity remains buoyant.Mergers and acquisitions (M&A) activity has proven resilient so far this year, despite higher volatility and lower equity returns. However, the derating of equities has neither depressed target valuations nor premiums paid by acquirers, particularly in Europe. The acceleration of M&A in 2018 could even approach the previous peak reached in 2015, at around USD 1.2 trillion in the US.Since...

Read More »When Do We Know These Are Delusional Markets

Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

Read More »Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017’s ‘known unknowns’ suggest a year of more mayhem awaits… Here’s a selection of key events in the year ahead (and links to Bloomberg’s quick-takes on each). January Donald Trump will be sworn in as U.S. president on Jan. 20.QuickTakes: Immigration Reform, Free Trade and Its Foes, Supreme Court, Oil Sands, Confronting Coal, Climate Change,...

Read More »Argor-Heraeus: Another giant Swiss gold refinery goes on the Sales Lot

Submitted by Ronan Manly, BullionStar.com News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital. Other interested buyers are also believed to have...

Read More »Argor-Heraeus: Another giant Swiss gold refinery goes on the Sales Lot

Submitted by Ronan Manly, BullionStar.com News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital. Other interested buyers are also believed to have...

Read More »Argor-Heraeus: Another giant Swiss gold refinery goes on the Sales Lot

Submitted by Ronan Manly, BullionStar.com News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital. Other interested buyers are also believed to have examined a bid for Argor-Heraeus, including Japanese refining group Asahi...

Read More »The Education Bubble: Is A Harvard MBA Worth $500,000?

College students are back at their desks this month facing bleak prospects. With tightening job markets leaving kids with no place else to go, universities continue to jack up fees. The upshot is growing signs that America is in the midst of an “education bubble,” just as big as those in stock, bond, and real estate markets. Case in point: four years at Harvard University now costs nearly $250,000 [1]. If you want an...

Read More »The Education Bubble: Is A Harvard MBA Worth $500,000?

The Education Bubble: Is A Harvard MBA Worth $500,000? Written by Peter Diekmeyer College students are back at their desks this month facing bleak prospects. With tightening job markets leaving kids with no place else to go, universities continue to jack up fees. The upshot is growing signs that America is in the midst of an “education bubble,” just as big as those in stock, bond, and real estate markets. Case in point: four years at Harvard University...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org