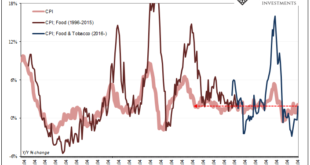

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More »The Historical Monetary Chinese Checklist You Didn’t Know You Needed For Christmas (or the Chinese New Year)

If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source. And the timing is equally as festive;...

Read More »China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy....

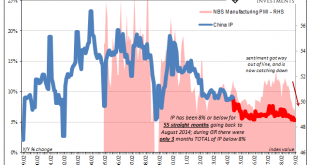

Read More »No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

Read More »FX Daily, November 28: Powell Awaited

Swiss Franc The Euro has fallen by 0.10% at 1.1262 EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global capital markets are relatively calm as investors gird for drama. The Bank of England reports its assessment of the impact of Brexit and the stress tests a little before Fed Chair Powell speaks at midday in NY. The G20 meeting...

Read More »FX Daily, November 20: Equity Slide Continues

Swiss Franc The Euro has fallen by 0.50% at 1.132 EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s 3% drop in the NASDAQ is setting the tone for today. The US stock market advance had been led by a narrow group of equities, and those have come under strong pressure amid slower consumer demand and stricter export control....

Read More »Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything. Because people are stupid, they will believe...

Read More »FX Daily, October 23: Stock Slump Pushes Yields Lower and Buoys Yen

Swiss Franc The Euro has fallen by 0.13% at 1.14 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: There is one main story today, and that is the resumption of the slide in equities. It is having a ripple effect through the capital markets. Bond yields are tumbling. Gold is firm. The dollar is narrowly mixed, though the yen stands out with almost a 0.5%...

Read More »FX Daily, July 06: Dollar Slips After Tariffs and Before Jobs Data

Swiss Franc The Euro has risen by 0.19% to 1.1629 CHF. EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The first set of US tariffs aims specifically at China were implemented, and the retaliatory actions were also launched. The tariffs cover hundreds of goods, though the initial amount of trade covered is relatively small at $34 bln....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org